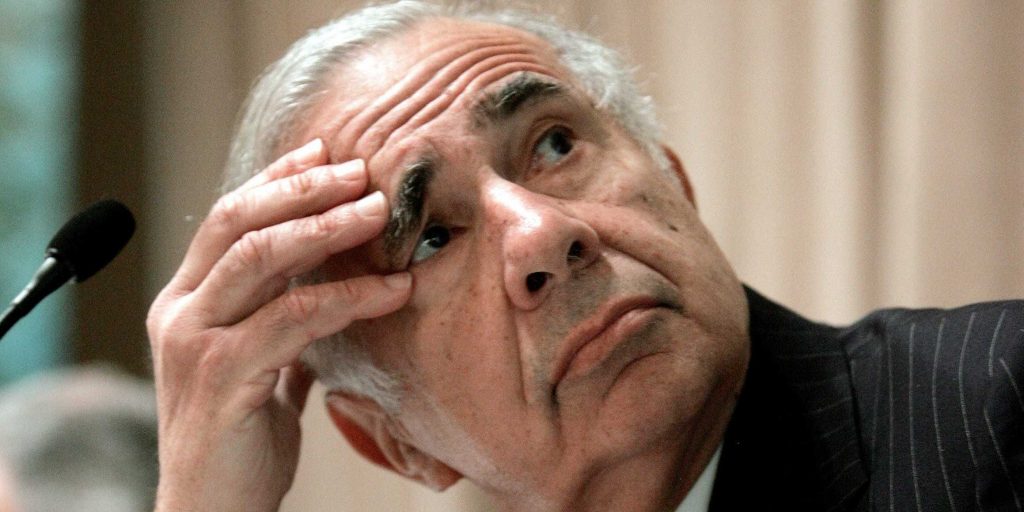

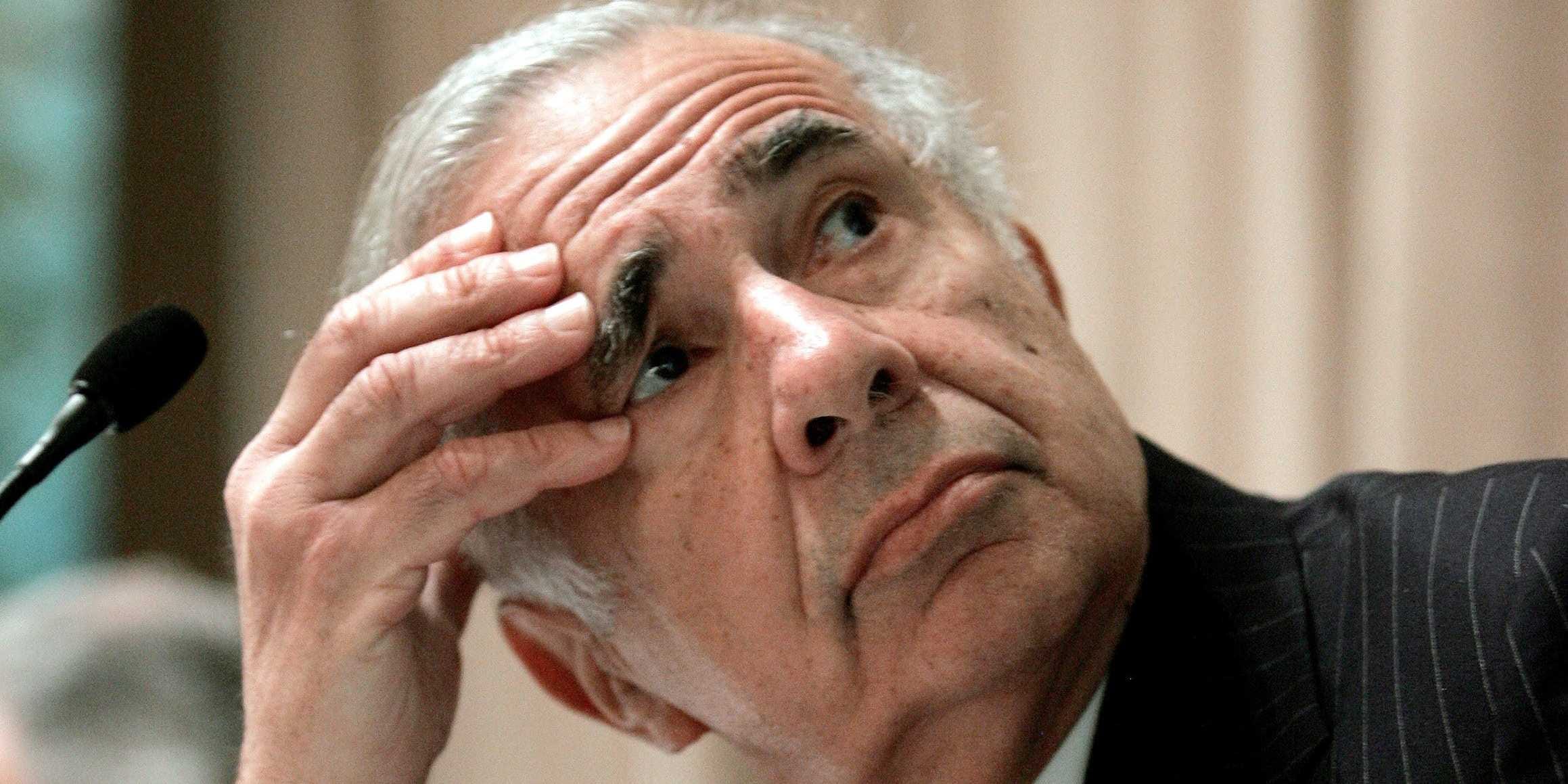

REUTERS/Jeff Zelevansky

- Carl Icahn revealed a nearly 5% stake in Southwest Gas this week.

- The billionaire investor urged the utility not to buy Questar Pipeline for almost $2 billion.

- Icahn highlighted several problems at Southwest, including rising costs and tensions with regulators.

- See more stories on Insider's business page.

Carl Icahn disclosed an almost 5% stake in Southwest Gas, and derided the utility's nearly $2 billion deal to buy Questar Pipeline, in a Securities and Exchange Commission filing on Tuesday.

The billionaire investor and Icahn Enterprises boss revealed his position after Reuters reported on Monday that Southwest was close to purchasing Questar from Dominion Energy. Despite Icahn's opposition, the two energy companies have announced the transaction will go ahead.

Icahn detailed his concerns in a scathing open letter to Southwest's board of directors. He called out the company's bosses for making "egregious errors at the expense of shareholders," and emphasized that acquiring Questar would "make all past errors pale in comparison" and destroy shareholder value.

The activist investor criticized Southwest executives for buying non-regulated assets in recent years, while their peers were selling peripheral assets to focus on regulated utilities. He also accused them of letting expenses balloon, hurting Southwest's credit profile, and failing to refresh the board. Moreover, he called out the company's declining return on equity and lackluster shareholder returns in recent years, and noted that its worsening relationship with regulators had caused "immeasurable damage."

"Even if you were not overpaying, this is no time for management with the many problems you have (including with regulators) to embark on a major new investment, especially when you have shown an inability to manage and control what you already own," Icahn said.

The energy company should focus on fixing its existing issues instead, as that could help increase its value by 75% or more, he argued. Southwest didn't immediately respond to a request for comment from Insider.

Warren Buffett's Berkshire Hathaway struck a $10 billion deal with Dominion to buy Questar and other assets last year, but scrapped the Questar portion of the transaction after regulators pushed back.

Buffett and Icahn previously crossed paths when another of Icahn's holdings, Occidental Petroleum, secured $10 billion in financing from Berkshire in 2019 to fund its $37 billion takeover of Anadarko Petroleum.

In exchange, Occidental handed over $10 billion worth of preferred stock paying a 8% dividend, along with about $1.2 billion worth of warrants to buy its stock at a discount in the future. Icahn, who loudly opposed the merger, complained that Buffett had taken Occidental's CEO "to the cleaners," and later ranked it among the "most ridiculous deals" he had ever seen.